Energy market indices moved lower in sync with Hong Kong broad stock indices as analysts digest Covid-19's impact on major cities in China such as Shenzhen and Shanghai and possible sanctions on China by the West for its support of Russia.

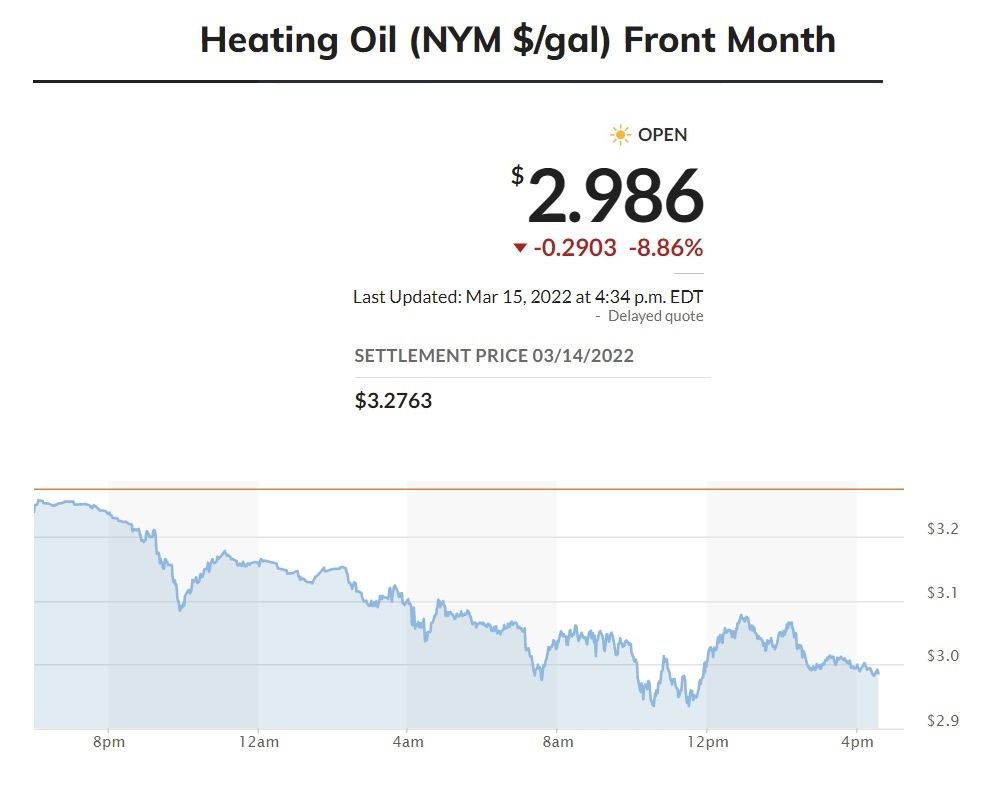

Brent futures fell below $100 a barrel on Tuesday, slumping by more than $9 since the previous close. West Texas Intermediate dropped below $95, having shed more than 20% in a tumultuous past week of trading that’s seen wild price fluctuations. NYMEX Heating Oil index moved below $3.00, an almost 9% drop.

NYMEX Heating Oil index moved below $3.00, an almost 9% drop.

A resurgence of Covid-19 cases in China, the world’s biggest crude importer, and ongoing developments in Ukraine have also both roiled prices in recent days.

The market is also in the midst of a liquidity crunch, leaving prices vulnerable to big swings. Clearing houses have been increasing margins -- effectively making it more expensive to trade the same amount of oil -- and open interest has collapsed to the lowest since 2015. The gap between bids and offers for WTI was six cents at times on Tuesday -- it would usually only be about half that amount -- another sign of a less active market.

In Hong Kong, the Hang Seng China Enterprises Index sank 6.6%, following a plunge in the previous session that was the biggest since the global financial crisis. Alibaba Group Holding Ltd. and Tencent Holdings Ltd. led the decline. The benchmark Hang Seng Index slumped 5.7%, its biggest decline since July 2015.

The wave of selling continued in U.S. premarket trading, with Alibaba’s American depositary receipts falling 4.6% further. Its e-commerce rivals JD.com Inc. and Pinduoduo Inc. dropped nearly 4% each. Almost all members in the Nasdaq Golden Dragon China Index were indicated lower, spanning shares of electric carmakers Nio Inc. and Li Auto Inc. to video platform Bilibili Inc. The index is at a near-decade low after $1.1 trillion in market value was wiped out from its peak last year.

China’s equities are looking increasingly risky on concerns that Beijing’s stand with Russia and its willingness to support Russian invasion of Ukraine could trigger U.S. sanctions. Chinese companies also face worries about U.S. regulatory developments including a possible delisting from the U.S. exchanges. For Chinese stocks, geo-politics outweigh fundamentals at this time. While upbeat economic data was a rare bright spot in the market, growing lockdowns in major Chinese cities following Chinese government's 'Dynamic zero policy' toward Covid-19 variant are dimming the outlook.

A well-known Chinese performer Jin Xing voiced support for Ukraine on her Weibo blog. Her blog was quickly censored, despite the fact that she has 13....more

入侵乌克兰的俄军并未实现闪电战的效果, 并未顺利攻下基辅。乌克兰人在总统的带领下, 向全世界展示出强大的抵抗毅志。 有消息称被派去进攻基辅的车臣部队被全数...more

22-year old Nathan Chen won the gold medal for his flawless and superb figure skating performance in the Beijing Olympics. He thanked his mother for s...more

An unelected ruler in a certain country, in the name of safety, has taken away people's right to free speech, to comment on, criticize the ruler's pol...more

Chinese tennis player Peng Shuai (彭帅) wrote and published a blog post on the night of November 2, 2021. After about 20 minutes, Peng Shuai's post ...more

Kong is a doctoral student at Purdue University majoring in civil engineering. In November, Kong published an article on ProPublica about the aggres...more

At a Wall Street Journal conference yesterday, Elon Musk calls for the Senate not to pass the $2 trillion Build Back Better Act and says Tesla doesn’...more

日本官员讲话婉转、客气是出了名的, 通常人们要猜测日本官员到底表达什么样的情感。然后一个前日本高官却十分明确、十分露骨地点名警告一个国家。 前日本首相 ...more

©2026 16J.com. All rights reserved.